Challenges

1. Adapting Existing Methodology for the United States

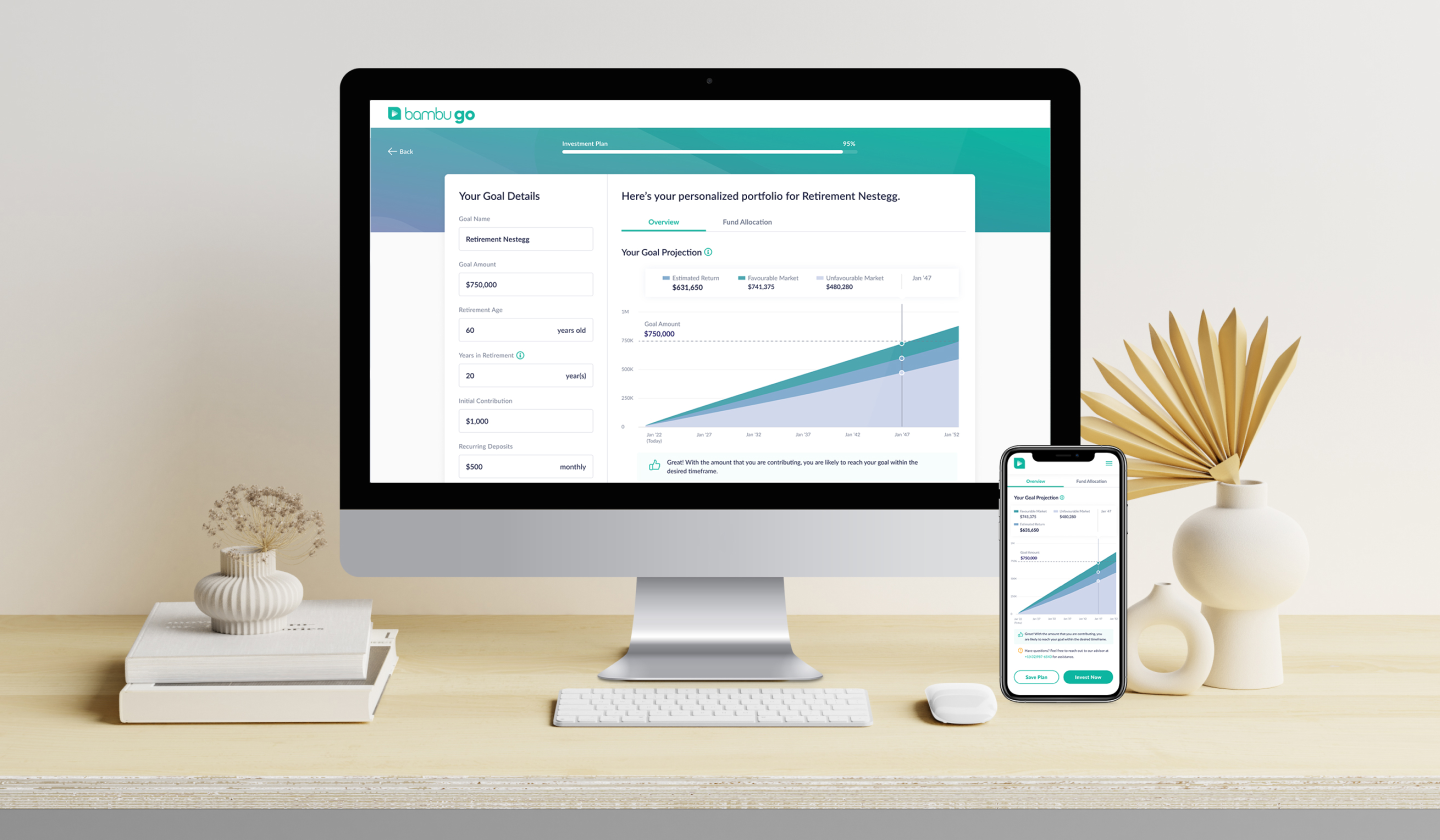

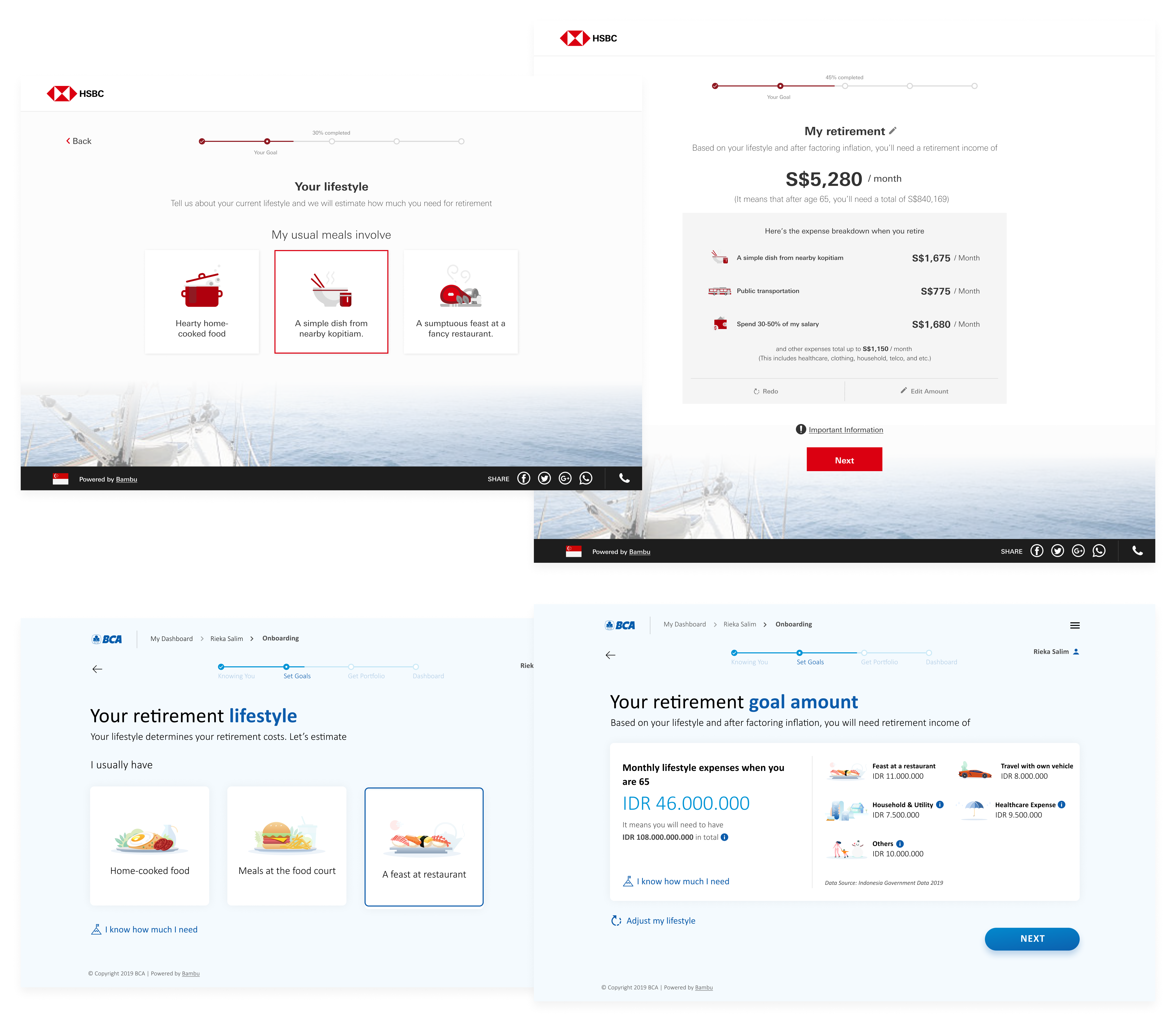

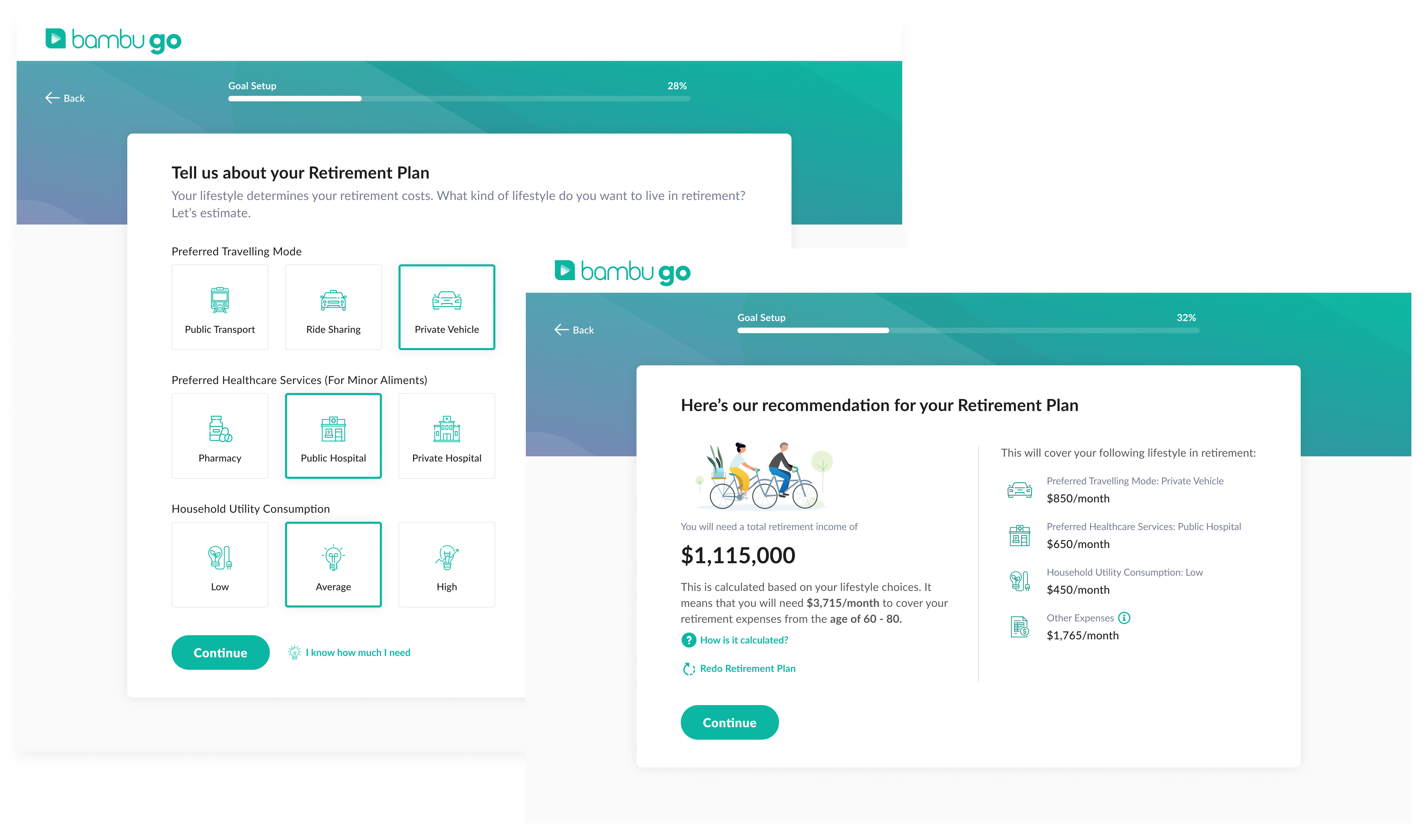

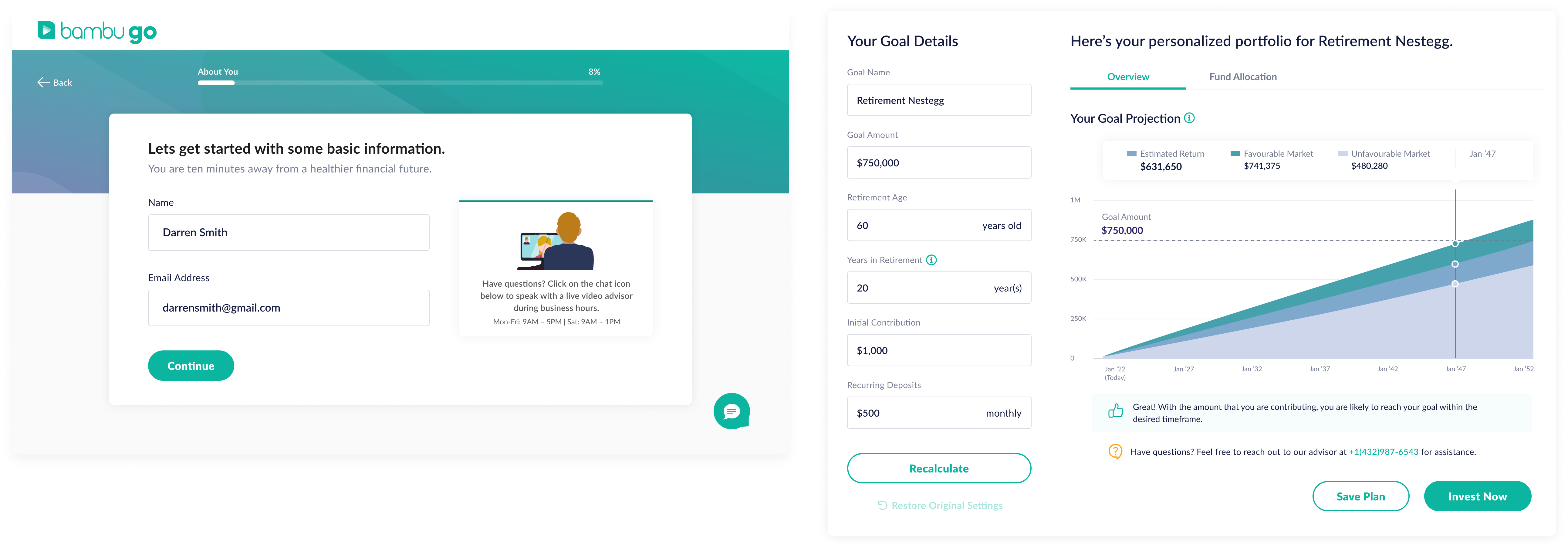

Before entering the U.S. market, we developed Robo Advisors for Southeast Asia, featuring a goal calculator, presented in an interactive lifestyle questionnaire. This well-received feature

enables investors to receive personalized investment recommendations that align with investors' goals based on their responses.

What didn't work

Option 1: Use lifestyle questions to help users calculate their retirement income.

When we presented this methodology to the U.S. client, they noted it tended to produce generalised recommendations. It lacks accuracy when applied in large countries like the U.S., with 50 states, and significant disparities in living costs between affluent and less affluent regions.

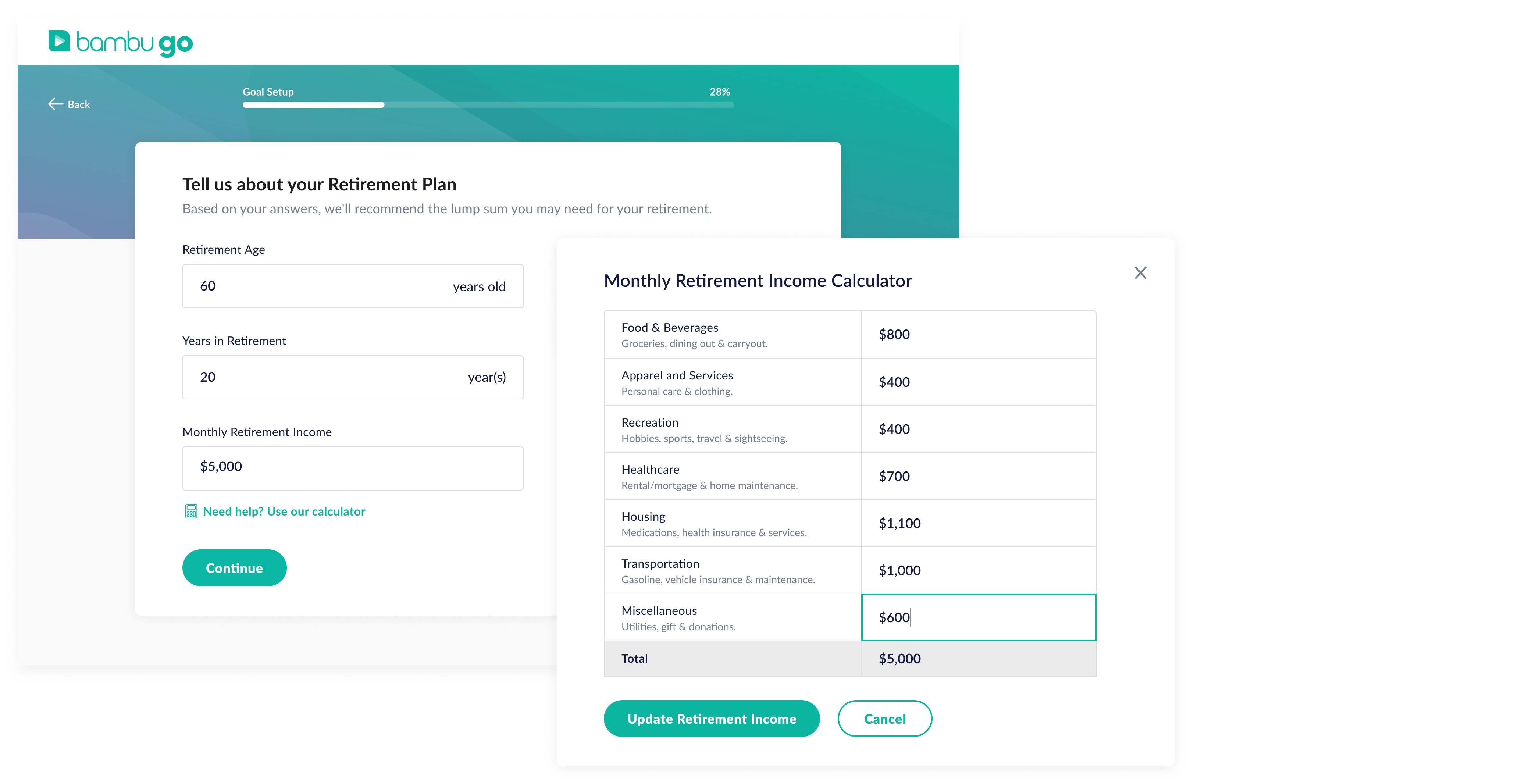

Option 2: Ask users to define their desired retirement income.

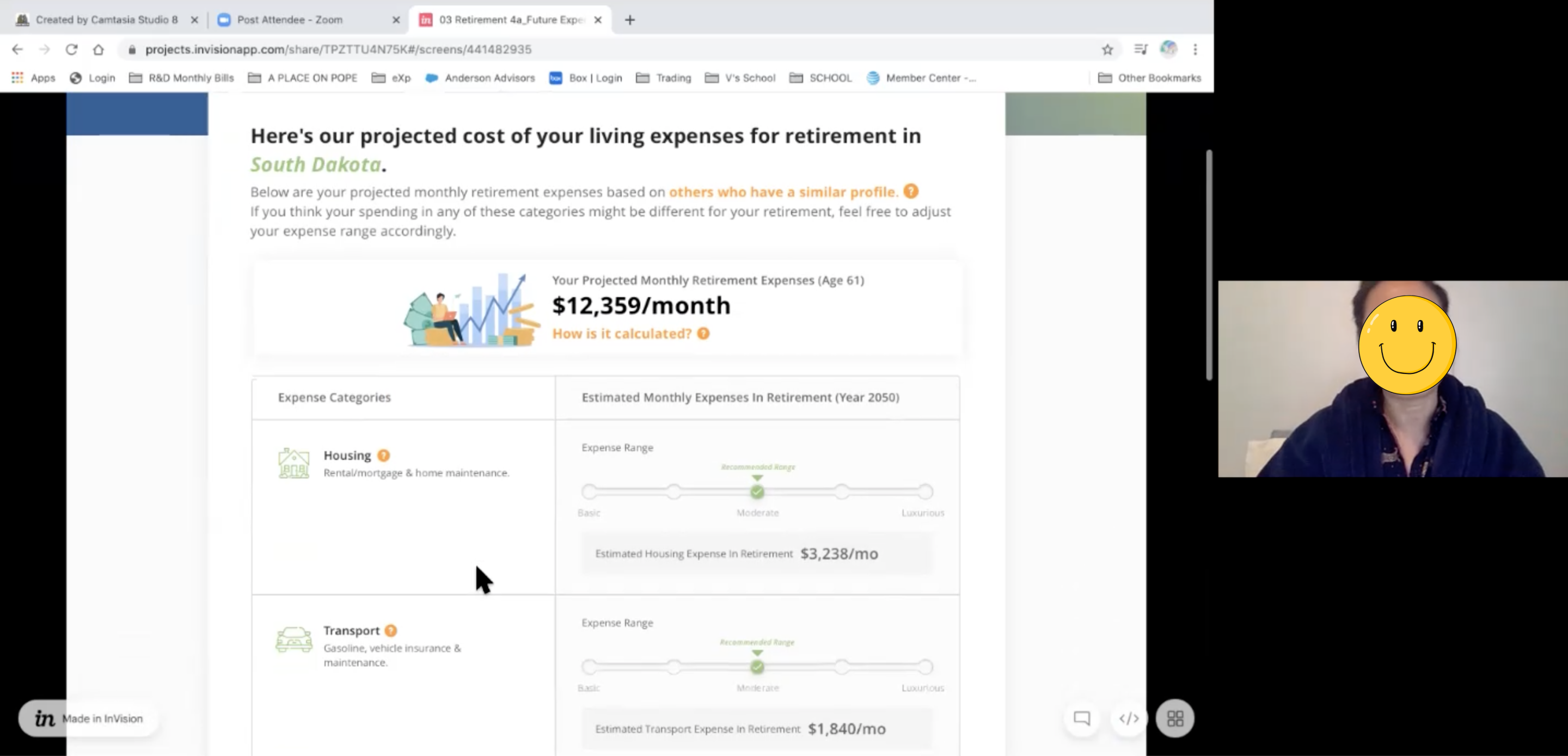

To enhance precision, we defined key expense categories in the U.S. and provided detailed breakdowns. This allowed users to set preferred amounts for each category, contributing to their targeted retirement income.

Asking users to define their retirement income contradicts the purpose of the Robo Advisor, which aims to offer tailored recommendations effortlessly. Testing showed prolonged decision-making and high dropout rates, highlighting its impracticality.

How we overcame the challenge

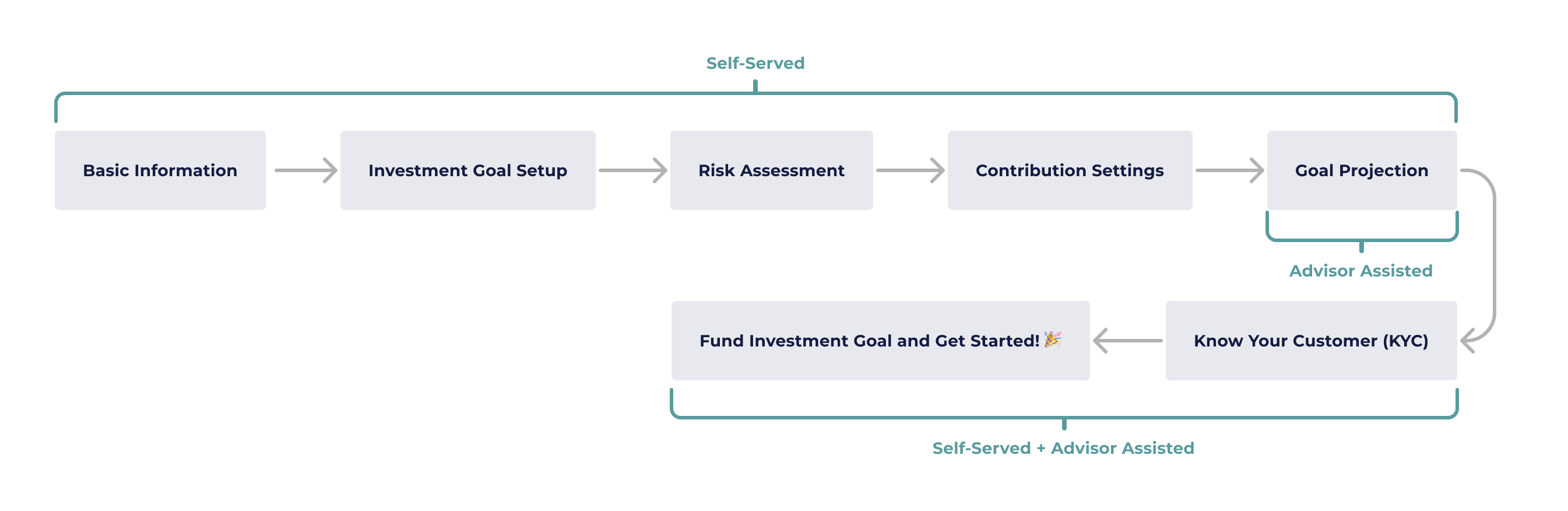

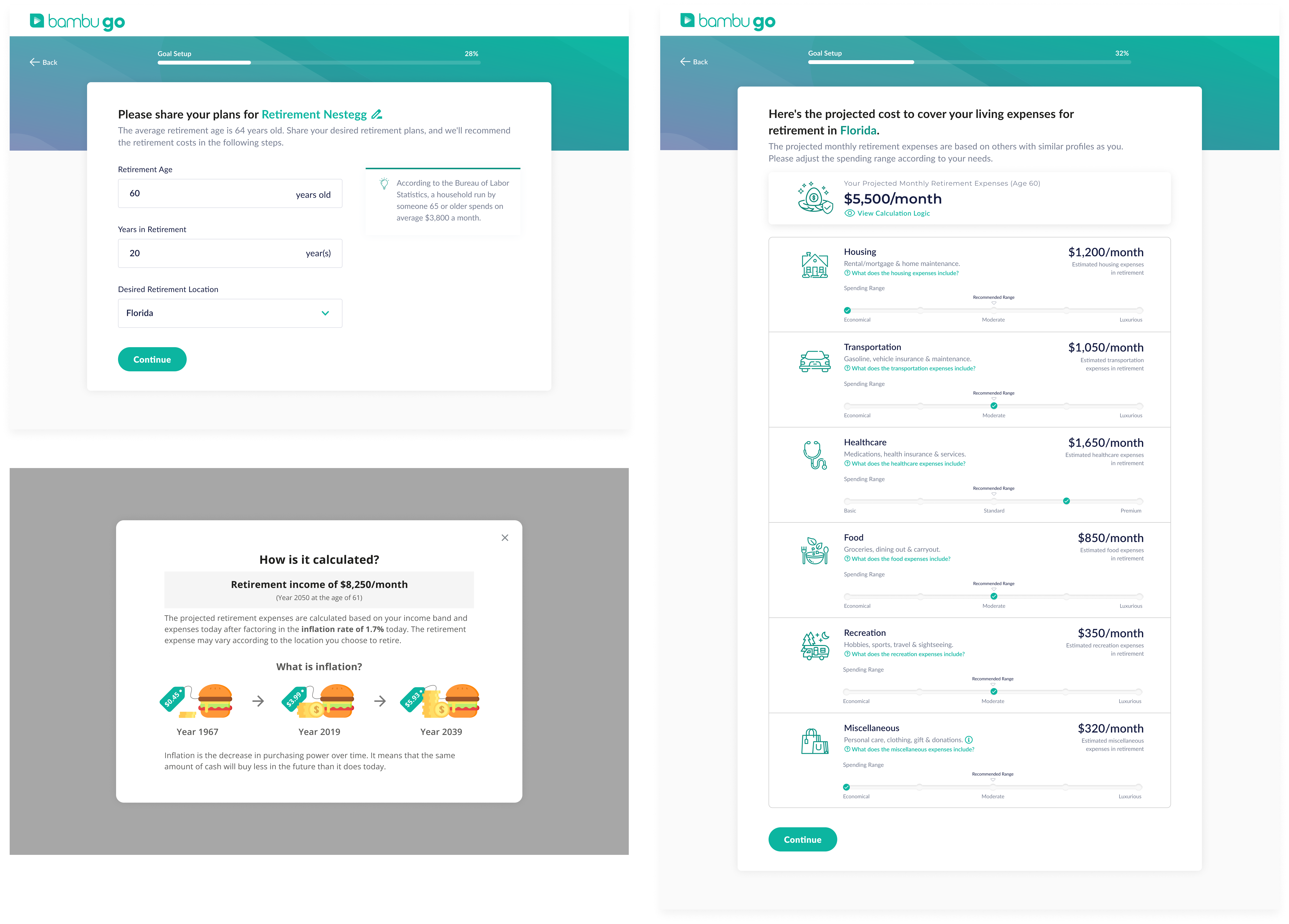

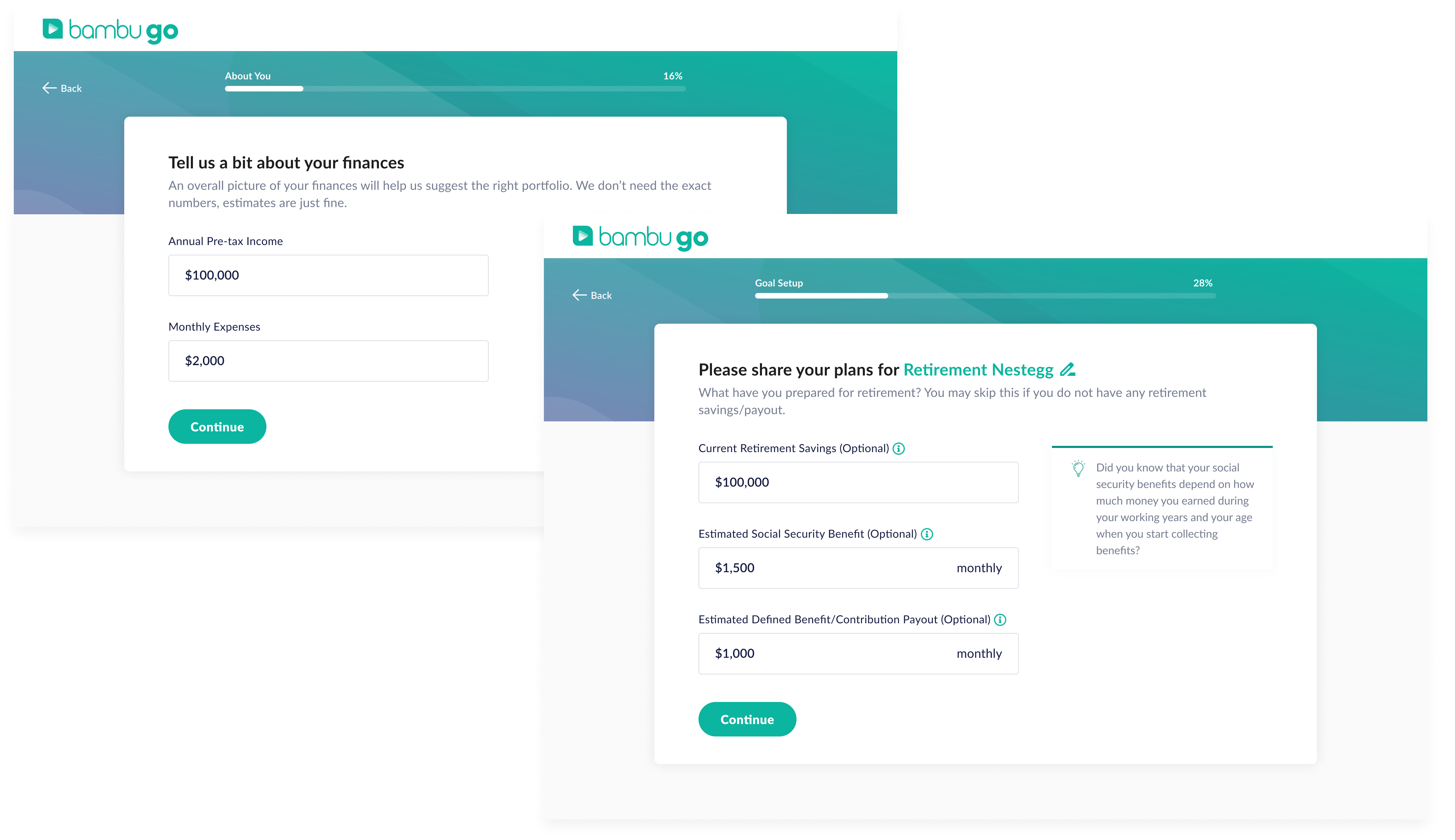

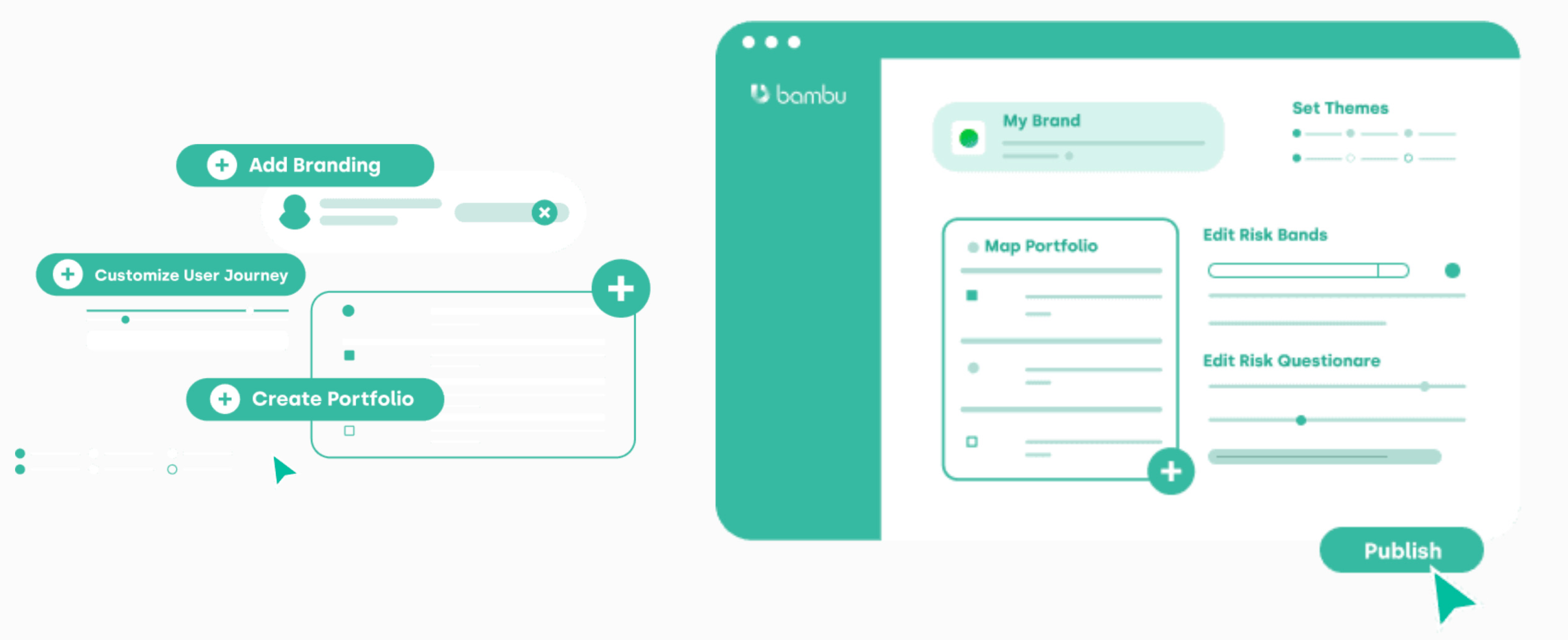

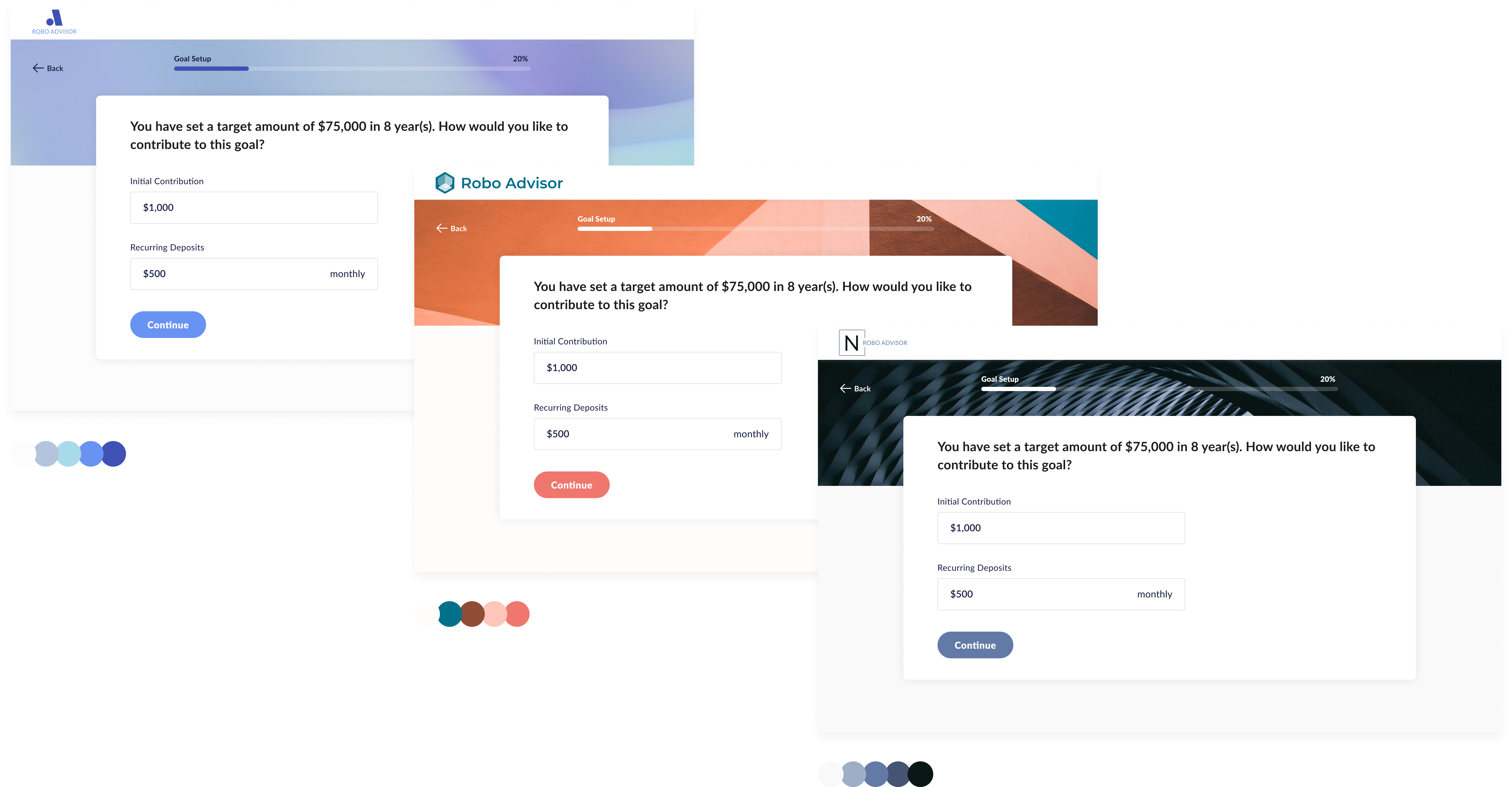

As a white-label solution provider, my team maintains flexibility to adjust the high-level user flow for new markets or clients. However, we must navigate tech constraints while accommodating new requirements to ensure scalability without overhauling our backend structure and APIs.

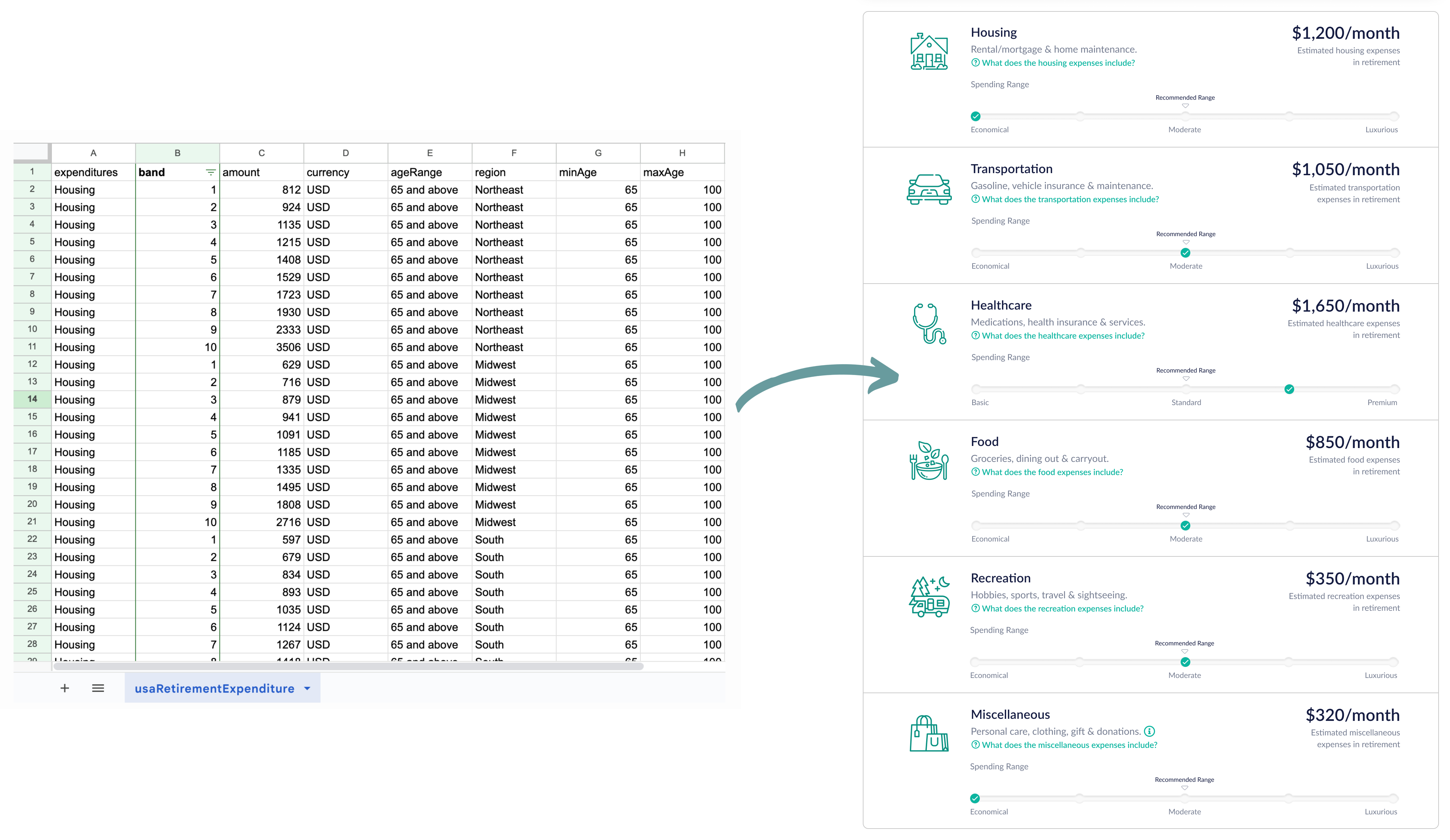

In response to feedback, I collaborated with the Solution Architect and Data Scientists to develop a comprehensive database of unique expense categories for each U.S. region. I then worked with the product team through multiple iterations to create simple and intuitive interfaces from the raw data, involving extensive reviews and critique sessions with internal stakeholders.

To create a seamless user experience, we utilise onboarding data to recommend preset expense ranges while allowing users to adjust categories based on lifestyle preferences.

2. Gathering Authentic User Feedback

After finalizing the new design, my next challenge is gathering authentic user feedback from native U.S. users. I was limited by strict data privacy regulations that prevented direct outreach to our client's customers.

To address this, I utilised secondary connections through colleagues and friends to recruit participants for usability tests, conducted during early morning or late-night sessions to accommodate time zone differences.